My Shopping Cart

My Shopping Cart

Technical Specifications – Full Range

| Model | Capacity (L) | Diameter (mm) | Height (mm) | Thickness (mm) | Wheels | Weight (kg) |

|---|---|---|---|---|---|---|

| Low Wheeled | 170 L | 570 | 660 | 0.8 | 3 | 17.5 |

| Low Wheeled | 210 L | 640 | 660 | 0.8 | 3 | 20 |

| Low Wheeled | 290 L | 750 | 660 | 0.8 | 4 | 24 |

| Tall Wheeled | 100 L | 550 | 1100 | 0.8 | 3 | 13 |

| Tall Wheeled | 180 L | 750 | 1100 | 0.8 | 4 | 20 |

*All measurements are approximate and may vary slightly.

In the pursuit of advancing olive oil quality, a groundbreaking development for the industry has emerged from a recent study that has illuminated how specific compounds — particularly secoiridoids — can substantially improve the oxidative stability and shelf life of ‘Corbella Extra Virgin Olive Oil (EVOO).

The collaborative Spanish study, carried out at an industrial mill, centered on assessing the influence of malaxation conditions and olive storage on the composition of ‘Corbella’ EVOO, offering insights with potentially transformative implications for the sector.

Extra Virgin Olive Oil is celebrated worldwide for its health-promoting properties and distinctive flavor, establishing itself as a culinary cornerstone across cultures. Nevertheless, its oxidative stability — a key factor in determining shelf life and overall quality — has long been the focus of intensive research. This latest investigation has presented compelling evidence that certain compounds play a decisive role in reinforcing EVOO’s stability.

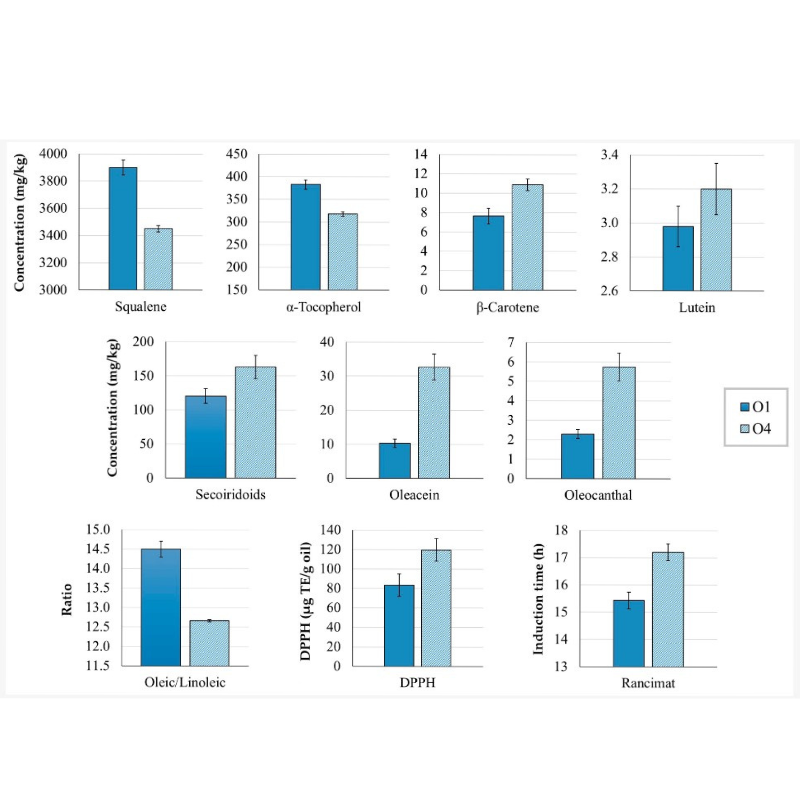

The principal compounds examined included phenolic compounds, tocopherols, carotenoids, squalene, and fatty acids, all of which are fundamental to the oil’s composition. The findings revealed that extended malaxation at higher temperatures, together with olive storage, negatively affected compounds such as α-tocopherol, squalene, flavonoids, lignans, phenolic acids, and phenolic alcohols. However, paradoxically, both the antioxidant capacity and oxidative stability of the oil improved under these conditions. This enhancement was attributed to a marked increase in the concentration of two secoiridoids: oleacein (56–71%) and oleocanthal (42–67%).

Oleacein and oleocanthal are widely recognized for their potent antioxidant activity, and this study has underscored their critical contribution to reinforcing EVOO’s stability and extending its shelf life. In addition, the research identified a synergistic interaction between secoiridoids and carotenoids, further highlighting their collective role in enhancing the resilience and longevity of EVOO.

Concentrations (mg/kg oil) of squalene, α-tocopherol, β-carotene, lutein, secoiridoids, oleacein, and oleocanthal in ‘Corbella’ Extra Virgin Olive Oil (EVOO) samples O1 and O4, along with the oleic/linoleic ratio, antioxidant capacity (DPPH, µg TE/g oil), and oxidative stability (Rancimat induction time, h). Sample O1 was produced on the day of harvest, while O4 was produced the following day using stored olives. Both EVOOs were malaxed at 18 °C for 30 minutes. Data are presented as mean ± standard deviation (n = 9). All parameters showed significant differences (p < 0.05) between samples.

One of the most notable discoveries was the ‘Corbella’ cultivar’s ability to yield EVOOs with a favorable oleic/linoleic ratio. The research indicated that storing olives overnight at ambient temperature, followed by malaxation at no less than 23 °C for 40–50 minutes (depending on the precise temperature), could substantially elevate the concentrations of oleacein and oleocanthal. This increase, in turn, contributed to a measurable improvement in the oxidative stability of EVOOs.

These findings represent a significant advancement in efforts to address and enhance EVOO stability, offering practical applications for producers aiming to extend shelf life while safeguarding quality.

The study also highlighted several promising avenues for future research. Key areas of interest include identifying strategies to further elevate oleacein and oleocanthal levels through agronomic and climatic variables, fruit maturity, and technological aspects of oil extraction.

Moreover, the evaluation of EVOO quality and stability over long-term storage, together with interventional studies assessing the direct influence of these secoiridoids on both product longevity and human health, remains a critical area requiring deeper exploration.

In summary, the research underscores the pivotal role of secoiridoids — particularly oleacein and oleocanthal — in enhancing oxidative stability and extending the shelf life of ‘Corbella’ EVOO. These insights hold dual significance: they offer tangible benefits for producers while also presenting potential health advantages for consumers, marking a milestone in the olive oil industry’s ongoing pursuit of excellence.

Research conducted by Alexandra Olmo-Cunillera 1,2ORCID,Maria Pérez 1,2ORCID,Anallely López-Yerena 1ORCID,Mohamed M. Abuhabib 1ORCID,Antònia Ninot 3ORCID,Agustí Romero-Aroca 3ORCID,Anna Vallverdú-Queralt 1,2ORCID andRosa Maria Lamuela-Raventós

About Secoiridoids

Secoiridoids exhibit a wide range of pharmacological properties, including anti-diabetic, antioxidant, anti-inflammatory, immunosuppressive, neuroprotective, anti-cancer, and anti-obesity effects. These diverse biological activities have significantly heightened scientific interest in the in-depth study of these bioactive compounds.

About Olive Oil Processing Technologies

Olive Oil Processing Plants: Compact Olive Oil Processing Machinery, Processing Lines from 500kgs/hr – 10T/hr & Specialised Machinery to Enhance Your Line

Processing Articles

INDUSTRY UPDATE: AUSTRALIAN OLIVE GROWERS 2023 SEASON

“Earlier in the season, the industry was anticipating an excellent harvest,” Mr Valmorbida said. “However, persistent cold weather and rainfall during May and June, particularly across south-east Australia, have taken their toll.”

Although the Australian olive harvest is not officially recorded each year, the AOOA estimates that the 2023 season will produce between 18 and 19 million litres of olive oil from roughly 110,000 to 120,000 tonnes of olives.

This compares with last year’s output of 14–15 million litres and the record-breaking 2021 crop, which yielded 20–22 million litres of oil.

Mr Valmorbida explained that these fluctuations reflect the biennial cycle of olive production. “This is what we call an ‘on’ year for olives. While we were expecting an excellent yield earlier in the year, harvest results always depend heavily on weather conditions, and this season has been quite mixed for many growers.”

“The oil yield per tonne is noticeably lower than average due to the cooler growing period,” he added, “but the quality of the oil remains excellent because the fruit had more time to ripen gradually.”

Around the world, olive oil prices have reached record highs in Spain, Italy, and Greece, driven by a severe global shortage of olive oil. Hot temperatures, minimal rainfall during key stages of the growing season, and extended drought conditions across southern Spain have drastically reduced European output. In addition, the ongoing conflict in Ukraine has disrupted the production of vegetable and seed oils, increasing global demand for olive oil as an alternative.

In Australia, growers are currently achieving $6–$7 per litre for larger commercial volumes of olive oil, with even higher prices for export batches, premium small-lot oils, and organic extra virgin olive oil.

“With this global shortage, some of the larger Australian producers are in a strong position to export olive oil to Europe and receive competitive returns,” Mr Valmorbida said.

“While that’s encouraging news for the Australian olive oil industry, globally the sector is under pressure,” he continued. “There’s currently a 35–40 percent shortfall in available products, combined with escalating packaging costs, especially for glass and tin materials.”

“These factors, along with rising labour and energy expenses, are leading to higher retail prices for consumers,” he noted.

Mr Valmorbida concluded with a reminder to consumers: “It’s important to remember there’s no product quite like olive oil—its distinctive flavour, health benefits, and culinary versatility make it irreplaceable.”

#oliveharvest2024 #harvest2024

The Australian Olive Oil Association (AOOA) is a not-for-profit, independent organisation dedicated to promoting the quality, integrity, and fair trade of olive oil in Australia. Membership is open to olive oil producers, distributors, industry stakeholders, and related organisations.

Since 1993, AOOA has been a signatory to the International Olive Council (IOC) global quality control program. Each year, the Association coordinates independent laboratory testing of leading olive oil brands to ensure compliance with IOC standards.

In addition, the AOOA Certified Quality Seal Program upholds even stricter quality criteria, allowing AOOA-member products to distinguish themselves in both domestic and international markets.

For more information:

Jan Jacklin, General Manager, Australian Olive Oil Association gm@aooa.com.au www.aooa.com.au

Photo credit: Julia, olive grove – Kyneton Olives” by avlxyz is licensed under CC BY-SA 2.0. To view a copy of this license, visit: https://creativecommons.org/licenses/by-sa/2.0/?ref=openverse

MARKET INSIGHT: GLOBAL OLIVE OIL ECONOMY 2023

Introduction

The global olive oil industry in 2023 has entered uncharted territory, experiencing an extraordinary surge in olive oil prices driven by a combination of climatic and economic forces. At the centre of this crisis lies Spain’s devastating drought, which has crippled the world’s largest olive oil producer. This severe shortage has led to a dramatic contraction in olive oil supply, triggering price escalation and a corresponding decline in consumer demand. The ripple effects are being felt worldwide, reshaping the balance between producers and consumers alike. Meanwhile, Australian olive oil producers find themselves in a rare position of advantage, benefitting from unprecedented market highs. This article explores the causes, consequences, historical trends, and economic signals surrounding this remarkable global olive oil price spike.

The ongoing drought across Spain stands as the principal factor behind the current olive oil price surge. As one of the largest olive oil-producing nations globally, Spain’s drastically reduced harvest - caused by months of extreme heat and minimal rainfall - has sharply curtailed olive oil availability in both European and international markets. This has intensified supply shortages, compelling consumers to pay more for what has long been a staple Mediterranean product. The interplay of limited supply and escalating demand has magnified price volatility, reinforcing the classic supply-and-demand imbalance now driving global markets.

Incredible to see the olive groves of Jaen, Spain. This one province produces around a fifth of the *entire* global supply of olive oil

— Secunder Kermani (@SecKermani) August 31, 2023

But a combination of drought & extreme heat has left many trees badly weakened... This years harvest looks set to be the worst in living memory pic.twitter.com/QYs41eXCwC

As prices have risen steeply, the shortage of olive oil has led to a noticeable decline in consumption, particularly in Spain, where demand has reportedly dropped by around 35%. Consumers are now scaling back their purchases, finding olive oil increasingly unaffordable compared to other cooking oils. The once-steady household consumption patterns are shifting as people seek alternatives or modify their cooking habits. This contraction in domestic demand not only highlights the growing accessibility gap for consumers but also underscores the broader economic strain caused by high inflation and food price increases.

Amid the turmoil, Australian olive oil producers are experiencing a windfall. Thanks to limited global supply, Australian growers are commanding record prices exceeding AUD $8 per litre, marking the highest levels ever recorded in the nation’s olive oil industry. This lucrative period presents a rare opportunity for Australian exporters, with demand from Europe - including Spain itself - now turning toward Australian supplies. For producers Down Under, this unique reversal of roles underscores how regional climate resilience and diversified production can translate into significant financial gains when global shortages arise.

The olive oil market’s volatility is not a new phenomenon. Previous spikes occurred in 1996, 2006, and 2015, each triggered by weather-related supply constraints. Yet, the 2023 price explosion stands out as the most dramatic in recorded history -over 40% higher than any previous price peak, and roughly double the magnitude of earlier surges. This extreme escalation reflects not just climatic hardship but a clear pricing bubble forming within the market, echoing the cyclical nature of commodity pricing.

The olive oil sector has long followed cyclical pricing patterns, typically alternating between low and high price phases roughly every decade. The current surge aligns almost perfectly with the predicted start of another 10-year cycle, occurring just three years into its anticipated timeline. Furthermore, a notable correlation has been identified between the Australian Food Inflation Index and the Global Olive Oil Price Index as reported by the International Monetary Fund (IMF). This connection illustrates the deep interdependence between food commodity pricing and global economic conditions.

While the IMF’s benchmark prices are denominated in USD, for the purposes of this analysis they have been converted to AUD to track the trend relative to Australian markets. These benchmark indicators -based on the world’s largest olive oil exporters -serve as a reliable gauge of overall market direction, confirming how global shortages and inflationary pressures move in tandem.

Global olive oil prices show a recurring 10-year cycle, driven by droughts, crop shortages, and rising production costs

Global olive oil prices show a recurring 10-year cycle, driven by droughts, crop shortages, and rising production costs

From a technical analysis perspective, the Relative Strength Indicator (RSI) is often used to measure price momentum and potential overextension in markets. On recent olive oil price charts, the RSI (represented in purple) indicates that prices have once again entered overbought territory - a level seen during previous speculative phases. Historically, such readings have preceded market corrections or reversals, suggesting that the current surge may not be sustainable in the long term.

Analysts caution that as the European olive harvest begins in September and October 2023, an influx of new oil supplies could help ease prices, though the timing and extent of this correction remain uncertain. Until then, speculative trading and limited inventory continue to support inflated market values.

The record-breaking olive oil prices of 2023, primarily triggered by Spain’s drought-induced production collapse, mark a turning point for the global olive oil economy. With consumer demand declining under the pressure of soaring prices and Australian producers thriving amid the scarcity, the industry is experiencing a dramatic rebalancing. Historical precedents, cyclical trends, and market indicators all point toward a complex, transitional period defined by volatility and uncertainty.

As the world’s producers, traders, and consumers adapt to these new market dynamics, one truth remains clear: olive oil - celebrated for its taste, health benefits, and cultural significance - continues to be at the mercy of both climate change and economic cycles. Stakeholders across the value chain must remain alert, flexible, and forward-thinking as the olive oil market navigates this extraordinary phase of transformation.

Other Sources

OLIVE OIL STORAGE

The Sansone Welded Fusti Tanks represent one of the most trusted stainless steel container designs in the food industry. Manufactured in Italy by Sansone, these tanks are built according to the highest international standards for the preservation of food-grade liquids such as olive oil, wine, honey, and food-grade liquids.

Each unit is produced using 18/10 AISI 304 stainless steel and is NSF certified, ensuring unmatched reliability, purity, and corrosion resistance. Their seamless welded construction guarantees easy cleaning and prevents the accumulation of organic matter or bacterial colonies - a crucial feature for industries where hygiene is paramount.

Built with head-to-head welding technology, the Sansone welded drums are designed to achieve maximum cleanliness and strength. This advanced welding method eliminates internal joints, making the surface completely smooth, which allows for easy sanitation and total prevention of bacterial growth.

These tanks are ideal for food processing, laboratory, and industrial applications that require hygiene compliant liquid handling. The seamless welded design also upholds that no residues or flavour transfer occur, maintaining the quality of your stored product.

Each model undergoes strict testing to meet the most rigorous quality standards and is part of Sansone’s commitment to producing long-lasting stainless steel containers that meet professional and domestic needs alike.

All models are equipped with a welded stainless-steel setup for a ½-inch tap, allowing safe and precise liquid dispensing. Each drum can also be paired with optional stainless steel or laminated stands, available in tall and short models or even with wheels for mobility.

Sansone provides several high-quality accessories to enhance functionality and handling convenience:

Each Sansone welded fusti is produced under ISO 9001:2000 certified quality control systems to ensure consistent performance and reliability. The use of premium-grade 18/10 stainless steel guarantees long life, even under demanding industrial use.

Whether used in olive oil production by producers, wineries, or laboratories, these tanks provide the peace of mind that comes from Italian-made precision engineering, smooth cleaning surfaces, and safe, airtight liquid containment.

For olive oil producers, the Sansone Europa welded tanks provide the ideal environment for oil preservation, protecting against oxidation and contamination while maintaining taste and freshness. The tanks’ sleek finish and robust structure also make them suitable for front-of-house or retail presentation, where hygiene and visual quality are essential.

From boutique olive oil farms to food manufacturers, these stainless steel fusti tanks represent a long-term investment in quality, safety, and professionalism.

If you’re ready to elevate your storage and preservation standards with Sansone stainless steel welded tanks, explore the full range at

https://theolivecentre.com/shop/stainless-steel-tanks-2l-to-99l

As Australia’s leading distributor for Sansone products, The Olive Centre provides expert advice, local support, and fast delivery — helping you choose the perfect stainless steel fusti to suit your needs

Preserving the integrity of high-quality foods and liquids - especially extra virgin olive oil (EVOO) - depends on two things: a sound understanding of correct storage parameters and the use of vessels engineered to uphold those conditions with absolute reliability. This is where Sansone, Italy’s premier stainless-steel tank manufacturer, stands far above conventional storage solutions. As global quality standards evolve, the industry has moved decisively away from breathable plastics & reactive metals. With increasing focus on purity, sustainability, and product shelf-life, food-grade stainless steel has become the internationally accepted gold standard for storing oils, beverages, ferments, honey, pharmaceuticals, and more. Within that space, Sansone’s range - distributed in Australia by The Olive Centre - has set the benchmark for durability, hygiene, and performance for over five decades.

International Olive Council (IOC) guidelines highlight the key threats to olive oil quality, i.e. oxygen, light, and heat, each of which accelerates oxidation and rancidity. Proper storage must therefore minimise air contact, prevent light exposure, and maintain stable, cool temperatures.

Sansone’s engineering and material choices align perfectly with these requirements:

1. Oxygen Protection: Airtight Design & Minimised Headspace

The IOC highlights that once a container is opened, limiting headspace is essential to slow oxidation.

How Sansone supports this:

The IOC identifies light as the main threat to olive oil quality after oxygen.

Sansone’s advantage:

The IOC recommends storing olive oil between 13 - 25°C, and notes that lower temperatures (even refrigeration) can slow oxidation.

Sansone excels in temperature resilience:

The IOC emphasises cleanliness, inert materials, and contamination avoidance.

Sansone tanks surpass these needs through:

5. Durability & Long-Term Value: Sustainability Meets Performance

Stainless steel is durable, corrosion-resistant, and 100% recyclable - maintaining its quality through multiple recycling loops. Sansone’s robust construction means a single tank can last decades, dramatically reducing lifecycle costs compared with plastics or coated metals. Their longevity also prevents product loss due to leaks, contamination, or light-induced degradation, making Sansone an economically and environmentally superior investment for producers of all scales.

| Criteria | Plastic Containers | Stainless Steel Containers (e.g. Sansone) | Glass Containers |

|---|---|---|---|

| Material Reactivity | It can leach plasticisers over time, especially with acidic or fatty products. | Completely inert; AISI 304/316 food-grade steel prevents reactions. | Inert to most liquids but may interact with extreme pH. |

| Light Protection | Allows light penetration unless opaque. | 100% light-proof - ideal for olive oil and sensitive liquids. | Transparent unless tinted; light accelerates oxidation. Coloured glass can slow down light penetration. |

| Oxygen Protection / Seal Quality | Moderate; lids may warp or expand, increasing oxygen exposure. | Excellent - airtight seals and precision threads limit oxygen exposure. | Good initially, but seals vary; headspace increases quickly once opened. |

| Durability | Prone to warping, cracking, and UV degradation. | Extremely durable - decades of use without deforming. | Fragile; breaks or chips easily. |

| Temperature Resistance | Sensitive to heat; may warp or release BPA-like compounds/plasticisers. | Highly stable across temperature ranges, including refrigeration and warm environments. | Stable but expands/contracts; risk of thermal shock. |

| Hygiene & Cleanability | Scratches retain residues and microbes; absorbs odours. | Mirror-polished surfaces prevent buildup; no odour retention; easy sanitation. | Very hygienic but difficult to clean if narrow-necked. |

| Impact on Olive Oil Quality | Can accelerate oxidation; not recommended by IOC for long-term storage. | Ideal - protects from light, heat, and oxygen; aligned with IOC guidelines. | Good if dark/tinted and stored cool, but still sensitive to light exposure. |

| Sustainability | Limited recyclability; degrades in quality each cycle. | 100% recyclable without quality loss; extremely long lifespan. | Highly recyclable but higher breakage rate. |

| Weight | Lightweight. | Moderately heavy (depending on tank size). | Heavy and cumbersome, especially in larger volumes. |

| Cost (Upfront) | Low | Higher initial investment | Moderate cost |

| Cost (Lifecycle) | High - due to frequent replacement and product spoilage risk. | Low - one tank often lasts decades; prevents losses from contamination or oxidation. | Moderate - replacement due to breakage or seal failure. |

| Suitability for Industrial Use | Poor - short lifespan and limited hygienic control. | Excellent - used in olive oil production, wineries, pharmaceuticals, honey, and beverage industries. | Limited - weight and fragility restrict large-volume use. |

| Suitability for Long-Term Food Storage | Not recommended. | Excellent - best long-term solution for oils, ferments, beverages, and extracts. | Acceptable for short-to-medium term if protected from light. |

Table. Comparison of Plastic, Stainless Steel, and Glass Containers for long-term storage of food and liquids.

6. Functional Design That Enhances Workflow

Across the entire Sansone range - from 3 L benchtop units to 10,000 L industrial vats - each model is tailored for real-world handling:

These design elements reduce labour time, improve occupational safety, and streamline production lines.

Thanks to their inertness and long service life, Sansone tanks have become essential across multiple industries:

As Australia’s leading supplier of olive and food-processing equipment, The Olive Centre selects only products with proven excellence, traceability, and long-term reliability.

The partnership with Sansone ensures Australian producers - from boutique growers to large commercial processors - gain access to:

When global storage guidelines emphasise controlling light, oxygen, and temperature to protect olive oil and other sensitive liquids, Sansone’s stainless steel tanks don’t just meet these parameters - they optimise them. Their precision engineering, food-safe materials, airtight design, and unmatched durability align perfectly with IOC recommendations, giving producers complete confidence that every drop remains as fresh, pure, and vibrant as the day it was created.

Extra virgin olive oil (EVOO) is extremely sensitive to light, oxygen, heat and metal contact. Packaging, therefore, plays a direct role in how long an olive oil remains “extra virgin.” Major reviews from UC Davis emphasise that optimal packaging must reduce light exposure, oxygen ingress, and headspace, while also ensuring cool storage. At the same time, producers—especially small to medium Australian growers—must consider costs, machinery requirements, recyclability, consumer preferences, and minimum order quantities (MOQ). Below is the most complete and updated comparison of all common packaging formats.

PET offers convenience and low cost but has moderate oxygen permeability and allows light penetration, which accelerates oxidation. A 2023 study showed PET-stored EVOO experienced higher acidity, peroxide values, UV oxidation indices and sensory degradation over 12 months—especially at elevated temperatures.

Migration of PET oligomers and antimony into oil is within regulatory limits, but increases under heat.

rPET has a lower carbon footprint than glass, but Australian recycling for PET varies by region.

Metal cans provide total light protection and excellent oxygen barrier characteristics. UC Davis stresses that lined cans effectively prevent metal migration and protect quality.

Compared with BIB, cans may show slightly faster oxidation when half-empty, but still protect oil well if stored cool. A 24-month study found both cans and BIB maintained EVOO within legal quality limits.

Steel and aluminium have high recycling rates in Australia.

Many producers prefer cans because Australian consumers are increasingly concerned about soft plastics, especially given the collapse of local soft-plastic recycling schemes (e.g., REDcycle).

Best for: Bulk, foodservice, premium oils, export, and producers who want reliability without specialised equipment.

Glass is chemically inert. Coloured glass offers some UV and visible light protection—amber performs better than green - but clear glass accelerates photo-oxidation significantly.

Coloured glass slows degradation but still allows some light through, so shelf lighting and storage conditions matter.

Highly recyclable, but heavy to transport. Bottle breakage is an inconvenience for producers.

Best for: Premium retail oils with attention to storage conditions.

Research shows clear glass provides almost no light protection, leading to rapid losses in phenolics and faster oxidation.

UC Davis warns that clear glass should be avoided unless heavily covered by labels or cartons.

Best for: Fast-moving products or promotional oils kept strictly in the dark.

Bag-in-box offers some of the best oxygen protection because the collapsing bag limits headspace oxygen, and the cardboard blocks light. Numerous studies, including 12- to 24-month trials, confirm superior preservation of phenolics, freshness, and sensory properties compared with bottles and cans.

Plastic contact and disposal concerns hinder adoption, despite technical superiority.

Best for: Large producers with dedicated filling lines, subscription models, or export markets where BIB is accepted.

BOV packaging uses a hermetically sealed internal pouch separated from an external propellant. The oil never contacts the propellant; instead, it is dispensed by pressure.

Best for: High-end culinary oils, premium lines, foodservice, and producers wanting differentiation without investing in BIB equipment.

| Packaging Type | Light Protection | Oxygen Protection | Machinery Required | Recyclability (Australia) | Cost | Consumer Acceptance | Best Use Case |

|---|---|---|---|---|---|---|---|

| Cans (lined) |

★★★★★

|

★★★★☆

|

Easy | High | Medium | High | Bulk, premium, foodservice |

| Bag-in-Box |

★★★★★

|

★★★★★

|

Specialised | Low (soft plastics) | High (at scale) | Medium–Low | Long shelf life, export |

| Coloured Glass |

★★★☆☆

|

★★★★★

|

Easy | High | Higher | Very High | Retail premium |

| Clear Glass |

★☆☆☆☆

|

★★★★★

|

Easy | High | Higher | High | Fast turnover only |

| PET Plastic |

★☆☆☆☆

|

★★☆☆☆

|

Easy | Moderate | Low | Medium | Value lines, short shelf life |

| Bag-on-Valve (BOV) |

★★★★★

|

★★★★★

|

Moderate | Low–Moderate | Higher | Medium–High | Premium spray oils |

Selecting the most suitable packaging for extra virgin olive oil hinges on finding the right balance between quality preservation, consumer expectations, and production practicality. Among all options, lined metal cans stand out as one of the most reliable and efficient choices: they are easy to fill by weight, offer excellent protection from light and oxygen, avoid consumer concerns around plastics, and are highly recyclable in Australia. Coloured glass bottles remain the strongest retail performer, pairing good product protection with strong shelf appeal and flexible filling options - from hand-applied caps to automated capping machines that minimise leakage risks. Clear glass should only be used for fast-moving products due to its poor light protection.

While innovative systems like bag-on-valve offer outstanding oxygen exclusion and controlled dispensing, their higher cost and MOQ requirements mean they are best suited for premium or specialised product lines. PET plastic bottles can work for value-oriented, short-shelf-life oils kept in cool, dark environments, but they are not ideal for long-term storage or premium markets.

Overall, Australian producers benefit most by matching each packaging format to the oil’s intended shelf life, sales channel, and brand positioning. Thoughtful packaging selection not only safeguards quality but also streamlines production and aligns with evolving consumer and environmental expectations.

References

When it comes to oil storage you need to consider the impacts on quality in relation to the proposed storage to be used.

This article is about some of the latest research as funded by RIRDC to determine the best storage for your oil.

Remember just because a manufacturer states the container(s) are food-grade doesn't necessarily means they are safe to use for olive oil. ?(All the containers used in this study were regarded as "Food Grade").

Here is a excerpt from the article:

For example, sometimes growers produce oil with very high quality initially, which quickly deteriorates due to the conditions under which it is stored,? he said.

The olive oil can deteriorate so much that it can no longer be classified as extra virgin olive oil, at a huge expense to the growers.

The changes in oil quality described in this report will encourage producers, as well as others in the supply chain of olive oil, to consider the facilities used to store olive oil in order to maintain the high-quality olive oil Australia is increasingly renowned for producing.

Read the article here....?Storing olive oil - Local News - News - General - Town and Country Magazine.