My Shopping Cart

My Shopping Cart

| Specification | GR-B Model | GR-25 Model |

|---|---|---|

| Capacity (L) | 550 | 750 | 950 | 1150 | 1500 | 2000 | 2500 |

| Electric Motor | 1.5 kW | 2.2 kW |

| Material | AISI 304 Stainless Steel | |

| Width (mm) | 850 | 1190 |

| Length (mm) | 1980 | 2450 | 2980 | 3480 | 2660 | 3740 | 3800 |

| Height (mm) | 1200 | 1780 |

| Weight (kg) | 700 | 1000 |

| Voltage (Vac) | 400 | |

| Frequency (Hz) | 50 | |

| Power Supply Line | 3F + T | |

| File | Title | File Description | Type | Section |

|---|---|---|---|---|

| basic-plus.pdf | Basic Plus Olive Paste Malaxer | Clemente | Functional Technical data sheet | Catalogue | Document |

This breakthrough technology represents the future of olive oil processing, with developments set to redefine efficiency and production performance. The Thermospeed system has demonstrated the capability to accelerate the olive oil extraction process by up to 50%, marking a significant advancement in processing speed and throughput.

At the core of the system is an innovative design that reduces malaxation time - the critical stage where the olive paste is gently mixed before separation. The Thermospeed achieves this by pumping the olive paste through a section surrounded by a temperature-controlled tube, which can either heat or cool the paste as needed. This process optimisation helps to enhance extraction efficiency while minimising oxidation, ultimately preserving the oil’s natural quality and nutritional value.

Early trials have shown no negative effects on olive oil quality, and research is continuing over the next 12 months to further evaluate and refine the system’s performance.

This remarkable innovation could soon be integrated into olive oil processing facilities worldwide, offering producers an efficient, sustainable, and scientifically proven step forward in extra-virgin olive oil production.

INDUSTRY UPDATE: AUSTRALIAN OLIVE GROWERS 2023 SEASON

“Earlier in the season, the industry was anticipating an excellent harvest,” Mr Valmorbida said. “However, persistent cold weather and rainfall during May and June, particularly across south-east Australia, have taken their toll.”

Although the Australian olive harvest is not officially recorded each year, the AOOA estimates that the 2023 season will produce between 18 and 19 million litres of olive oil from roughly 110,000 to 120,000 tonnes of olives.

This compares with last year’s output of 14–15 million litres and the record-breaking 2021 crop, which yielded 20–22 million litres of oil.

Mr Valmorbida explained that these fluctuations reflect the biennial cycle of olive production. “This is what we call an ‘on’ year for olives. While we were expecting an excellent yield earlier in the year, harvest results always depend heavily on weather conditions, and this season has been quite mixed for many growers.”

“The oil yield per tonne is noticeably lower than average due to the cooler growing period,” he added, “but the quality of the oil remains excellent because the fruit had more time to ripen gradually.”

Around the world, olive oil prices have reached record highs in Spain, Italy, and Greece, driven by a severe global shortage of olive oil. Hot temperatures, minimal rainfall during key stages of the growing season, and extended drought conditions across southern Spain have drastically reduced European output. In addition, the ongoing conflict in Ukraine has disrupted the production of vegetable and seed oils, increasing global demand for olive oil as an alternative.

In Australia, growers are currently achieving $6–$7 per litre for larger commercial volumes of olive oil, with even higher prices for export batches, premium small-lot oils, and organic extra virgin olive oil.

“With this global shortage, some of the larger Australian producers are in a strong position to export olive oil to Europe and receive competitive returns,” Mr Valmorbida said.

“While that’s encouraging news for the Australian olive oil industry, globally the sector is under pressure,” he continued. “There’s currently a 35–40 percent shortfall in available products, combined with escalating packaging costs, especially for glass and tin materials.”

“These factors, along with rising labour and energy expenses, are leading to higher retail prices for consumers,” he noted.

Mr Valmorbida concluded with a reminder to consumers: “It’s important to remember there’s no product quite like olive oil—its distinctive flavour, health benefits, and culinary versatility make it irreplaceable.”

#oliveharvest2024 #harvest2024

The Australian Olive Oil Association (AOOA) is a not-for-profit, independent organisation dedicated to promoting the quality, integrity, and fair trade of olive oil in Australia. Membership is open to olive oil producers, distributors, industry stakeholders, and related organisations.

Since 1993, AOOA has been a signatory to the International Olive Council (IOC) global quality control program. Each year, the Association coordinates independent laboratory testing of leading olive oil brands to ensure compliance with IOC standards.

In addition, the AOOA Certified Quality Seal Program upholds even stricter quality criteria, allowing AOOA-member products to distinguish themselves in both domestic and international markets.

For more information:

Jan Jacklin, General Manager, Australian Olive Oil Association gm@aooa.com.au www.aooa.com.au

Photo credit: Julia, olive grove – Kyneton Olives” by avlxyz is licensed under CC BY-SA 2.0. To view a copy of this license, visit: https://creativecommons.org/licenses/by-sa/2.0/?ref=openverse

MARKET INSIGHT: GLOBAL OLIVE OIL ECONOMY 2023

Introduction

The global olive oil industry in 2023 has entered uncharted territory, experiencing an extraordinary surge in olive oil prices driven by a combination of climatic and economic forces. At the centre of this crisis lies Spain’s devastating drought, which has crippled the world’s largest olive oil producer. This severe shortage has led to a dramatic contraction in olive oil supply, triggering price escalation and a corresponding decline in consumer demand. The ripple effects are being felt worldwide, reshaping the balance between producers and consumers alike. Meanwhile, Australian olive oil producers find themselves in a rare position of advantage, benefitting from unprecedented market highs. This article explores the causes, consequences, historical trends, and economic signals surrounding this remarkable global olive oil price spike.

The ongoing drought across Spain stands as the principal factor behind the current olive oil price surge. As one of the largest olive oil-producing nations globally, Spain’s drastically reduced harvest - caused by months of extreme heat and minimal rainfall - has sharply curtailed olive oil availability in both European and international markets. This has intensified supply shortages, compelling consumers to pay more for what has long been a staple Mediterranean product. The interplay of limited supply and escalating demand has magnified price volatility, reinforcing the classic supply-and-demand imbalance now driving global markets.

Incredible to see the olive groves of Jaen, Spain. This one province produces around a fifth of the *entire* global supply of olive oil

— Secunder Kermani (@SecKermani) August 31, 2023

But a combination of drought & extreme heat has left many trees badly weakened... This years harvest looks set to be the worst in living memory pic.twitter.com/QYs41eXCwC

As prices have risen steeply, the shortage of olive oil has led to a noticeable decline in consumption, particularly in Spain, where demand has reportedly dropped by around 35%. Consumers are now scaling back their purchases, finding olive oil increasingly unaffordable compared to other cooking oils. The once-steady household consumption patterns are shifting as people seek alternatives or modify their cooking habits. This contraction in domestic demand not only highlights the growing accessibility gap for consumers but also underscores the broader economic strain caused by high inflation and food price increases.

Amid the turmoil, Australian olive oil producers are experiencing a windfall. Thanks to limited global supply, Australian growers are commanding record prices exceeding AUD $8 per litre, marking the highest levels ever recorded in the nation’s olive oil industry. This lucrative period presents a rare opportunity for Australian exporters, with demand from Europe - including Spain itself - now turning toward Australian supplies. For producers Down Under, this unique reversal of roles underscores how regional climate resilience and diversified production can translate into significant financial gains when global shortages arise.

The olive oil market’s volatility is not a new phenomenon. Previous spikes occurred in 1996, 2006, and 2015, each triggered by weather-related supply constraints. Yet, the 2023 price explosion stands out as the most dramatic in recorded history -over 40% higher than any previous price peak, and roughly double the magnitude of earlier surges. This extreme escalation reflects not just climatic hardship but a clear pricing bubble forming within the market, echoing the cyclical nature of commodity pricing.

The olive oil sector has long followed cyclical pricing patterns, typically alternating between low and high price phases roughly every decade. The current surge aligns almost perfectly with the predicted start of another 10-year cycle, occurring just three years into its anticipated timeline. Furthermore, a notable correlation has been identified between the Australian Food Inflation Index and the Global Olive Oil Price Index as reported by the International Monetary Fund (IMF). This connection illustrates the deep interdependence between food commodity pricing and global economic conditions.

While the IMF’s benchmark prices are denominated in USD, for the purposes of this analysis they have been converted to AUD to track the trend relative to Australian markets. These benchmark indicators -based on the world’s largest olive oil exporters -serve as a reliable gauge of overall market direction, confirming how global shortages and inflationary pressures move in tandem.

Global olive oil prices show a recurring 10-year cycle, driven by droughts, crop shortages, and rising production costs

Global olive oil prices show a recurring 10-year cycle, driven by droughts, crop shortages, and rising production costs

From a technical analysis perspective, the Relative Strength Indicator (RSI) is often used to measure price momentum and potential overextension in markets. On recent olive oil price charts, the RSI (represented in purple) indicates that prices have once again entered overbought territory - a level seen during previous speculative phases. Historically, such readings have preceded market corrections or reversals, suggesting that the current surge may not be sustainable in the long term.

Analysts caution that as the European olive harvest begins in September and October 2023, an influx of new oil supplies could help ease prices, though the timing and extent of this correction remain uncertain. Until then, speculative trading and limited inventory continue to support inflated market values.

The record-breaking olive oil prices of 2023, primarily triggered by Spain’s drought-induced production collapse, mark a turning point for the global olive oil economy. With consumer demand declining under the pressure of soaring prices and Australian producers thriving amid the scarcity, the industry is experiencing a dramatic rebalancing. Historical precedents, cyclical trends, and market indicators all point toward a complex, transitional period defined by volatility and uncertainty.

As the world’s producers, traders, and consumers adapt to these new market dynamics, one truth remains clear: olive oil - celebrated for its taste, health benefits, and cultural significance - continues to be at the mercy of both climate change and economic cycles. Stakeholders across the value chain must remain alert, flexible, and forward-thinking as the olive oil market navigates this extraordinary phase of transformation.

Other Sources

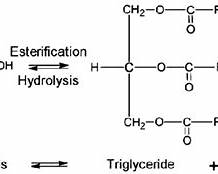

Esterification is a natural chemical reaction where free fatty acids (FFA) combine with alcohols, typically glycerol, to form esters. This process reduces the measurable acidity of the oil. While esterification can occur in the olive paste during milling, it is usually a minor contributor to quality changes compared with factors such as fruit condition, malaxation parameters, and extraction efficiency.

This diagram outlines the continuous olive oil extraction line: olives are crushed, malaxed, separated, clarified, and routed for bottling, while husk and wastewater are channelled to waste management systems.

Processing aids act physically or chemically on the olive paste. Some enhance enzyme activity, others alter pH or moisture, and a few influence esterification indirectly. Below is a breakdown of the main aids used by professional olive processors and how each relates to esterification.

Calcium carbonate is the processing aid most associated with apparent esterification effects.

Influence on esterification

Salt acts primarily on the physical structure of the paste rather than the oil chemistry.

Influence on esterification

Talc is inert and valued for its physical functionality.

Influence on esterification

Commercial enzyme blends can influence chemistry indirectly.

Influence on esterification

These clay minerals are used more for paste modification or clarification.

Influence on esterification

| Processing Aid | Impact on Esterification | Notes |

|---|---|---|

| Calcium Carbonate | Moderate … via pH shift | Can lower measured FFA but may affect flavour and oxidation |

| Salt (NaCl) | None | Improvements come from better separation, not chemical change |

| Talc | None | Purely physical aid for difficult pastes |

| Enzymes | Minor, indirect | Mostly physical… chemical breakdown of cell walls |

| Kaolin | None | Improves rheology only |

| Bentonite | None | Used for clarification rather than extraction |

Professional olive mills benefit from:

Esterification occurs when free fatty acids (FFA) in olives or olive paste react with natural alcohols—most commonly glycerol—to form esters. While this is a natural chemical reaction found in many biological systems, it usually plays only a small role during standard olive oil extraction. However, under certain processing or fruit-quality conditions, esterification can become more noticeable and can affect how acidity is interpreted during quality assessment.

Understanding when and why esterification occurs is important for mill operators, as it can influence extraction decisions, processing aid use, and the accuracy of acidity readings that determine Extra Virgin classification.

Esterification is not inherently harmful, but it becomes more noticeable when fruit quality is compromised or when additives alter the paste’s pH and reaction environment. This means that an oil’s reduced measurable acidity may not always reflect true quality improvement.

1. Higher Paste Temperatures

4. Extended Contact Time

5. Enzymatic Activity

When esterification occurs under the conditions described above, it can lower the measured FFA without actually improving the oil’s true chemical quality. This can mislead producers into thinking their processing steps or additives improved the oil, when in reality the acidity reduction was simply a chemical conversion—not a restoration of fruit integrity.

Producers who understand these mechanisms can:

In simple terms: Esterification becomes noticeable when the olive paste is warm, slightly alkaline, contains damaged fruit components, or sits too long before separation. Managing these factors helps prevent misleading acidity readings and supports genuine quality improvements.

Valuing your olive oil processing machinery – from presses and decanters to tractors and harvesters – is an important task for Australian producers. Whether you’re a small boutique grove or a commercial olive operation, knowing what your equipment is worth helps with insurance, resale, and financial planning. This guide explains how to value used olive oil processing machinery (with notes on new equipment costs), covers multiple valuation methods, and offers a practical Australian context. We’ll also include example scenarios (like a decade-old olive press vs. a nearly new separator) and provide tips to maintain your gear’s value over time.

Olive oil production involves specialised machinery at harvest and processing time. Key processing equipment includes olive crushers or mills (to crush olives into paste), malaxers (which slowly mix the paste), and centrifugal decanters/separators (which separate oil from water and solids). Supporting items like pumps, olive washers, and filtration units are also part of the system. Many Australian groves also use standard farm equipment such as tractors, mechanical harvesters, pruning and spraying equipment, and irrigation systems. When assessing value, focus first on the core olive oil machinery, but remember that methods discussed here apply to your tractors, harvesters, and other farm gear as well.

Modern olive processing machinery is a significant investment. For reference, a small continuous-flow olive mill (e.g. 30 kg/hour throughput) might cost around A$20,000 new, while a large commercial plant (capable of ~1 tonne/hour) can run into the hundreds of thousands of dollars. Such figures underscore why proper valuation is essential – these assets represent major capital on the farm. Below, we outline several methods to evaluate what these machines are worth, especially as they age or when considering second-hand purchases.

Valuing used farm equipment is not an exact science – it’s often best to use multiple methods to triangulate a reasonable value. Common approaches include using depreciation schedules, comparing recent market sales, calculating value based on income or cost savings, considering insurance replacement cost, and accounting for residual (salvage) value. Each method gives a different perspective:

Depreciation is the loss in value of equipment as it ages. A simple way to estimate a used machine’s value is to start from its original cost and subtract depreciation. There are two main depreciation methods: straight-line (also called prime cost) and declining-balance (diminishing value). Straight-line depreciation assumes the asset loses value evenly over its useful life, while declining-balance depreciation assumes a higher loss in early years and less in later years.

For instance, if a small olive press was purchased new for $30,000 and has a 15-year life, straight-line depreciation would be ~6.67% per year (100/15). After 10 years (two-thirds of its life), it would be about 10 × 6.67% ≈ 66.7% depreciated. In simple terms, its book value might be roughly 33% of the original cost (around $10,000 in this example). This assumes no residual value; in practice, you might add a small salvage value (see Residual Value section) instead of depreciating to zero.

Example (Depreciation Method): You bought an olive mill for $100,000 new, which is now 10 years old. Using straight-line (15-year life), its book value would be roughly $100k × (5/15) = $33k remaining. Using diminishing value (13.33% yearly), its book value might be closer to $24k–$25k after 10 years. You could cite these as a range – perhaps saying the machine is “approximately $25k–$33k based on age” – then adjust up or down for condition. If your equipment’s been exceptionally well maintained or lightly used, it might fetch more than the book value; if it’s in rough shape, it could be less.

One of the most practical valuation methods is to see what the market is willing to pay for similar equipment. Check recent listings and sales of comparable olive oil machinery or farm equipment. In Australia, useful platforms include:

Example (Market Comparison): Suppose you own a 10-year-old press (same as above) and find two similar presses listed: one in NSW for $40k (fully serviced, ready for work) and one in SA for $30k (sold as-is, needs some repairs). If your machine is in good working order with maintenance records, the market approach might suggest a value in the high $30k’s. You’d then cross-check this against the $24k–$33k depreciation estimate – if the market seems to be paying a premium (perhaps due to a shortage of used presses), you might lean toward the upper end of the range. On the other hand, if no one is buying presses because many olive groves use custom processing services, you might have to price on the lower end to attract interest.

Another angle is to value equipment based on the income it produces or the savings it provides. This method essentially asks: How much is this machine worth to my farm’s profitability? There are a couple of ways to think about it:

Example (Income Approach): Consider a recently purchased separator (centrifuge) that cost $15,000 new and is only 2 years old. Depreciation might put it at $10k–$12k book value now. But you bought it to improve your oil quality and yield – and indeed, oil yields went up 5%, earning you an extra $5,000 in oil sales each year. If we assume it has at least 8 years of life left, that’s potentially $40k additional income coming. Even discounting future years, the value-in-use of that separator might be on the order of $30k. Of course, no one would pay $30k for a used unit when a new one is $15k, but this tells you that for your own insurance, you might want it covered for replacement cost, and that selling it would only make sense if you exit the business or get a bigger unit. In other words, the ROI approach here tells you the separator is “worth more to me on the farm than to anyone buying it,” so you’d hold onto it unless necessary.

From an insurance perspective, valuation is about ensuring you could replace the equipment if it’s damaged or lost. There are two main concepts used by insurers:

Where to find replacement costs? Contact dealers or check current price lists for the closest equivalent new model. For instance, if your 2008 olive mill is no longer sold, find the price of the current model with a similar capacity. Don’t forget to include freight to your location and installation costs in the replacement figure, as a new machine often involves these. In Australia, companies like The Olive Centre or Olive Agencies can provide quotes for new machinery. We saw earlier that small Oliomio units started around $19.5k a few years back – those prices can guide insurance values for hobby-scale equipment. For larger systems, get a formal quote if possible, since custom setups vary widely.

Also, consider partial loss scenarios: insurance may cover repairs. If you have an older machine, parts might be scarce, so even repairs could approach replacement cost. This is another reason some farmers insure older critical items for replacement cost if they can.

Tip: Document your equipment’s details (serial numbers, specs) and keep evidence of its condition. In an insurance assessment, having maintenance logs, photos, and appraisals can support your valuation. Insurers might depreciate based on a generic schedule, but if you can show your press was fully refurbished last year, you have a case for a higher value. As one farm insurer explains, typically anything over ~8–10 years might only get ACV coverage. If your gear is older but in mint condition or has an ongoing role generating income, discuss options with your insurer – you might opt for a higher agreed value or a policy rider for replacement.

No matter which method you use, don’t forget that machinery usually has some residual value at the end of its useful life. This could be as spare parts, scrap metal, or a second life in a lower-intensity setting. Incorporating residual value prevents undervaluing the asset (and avoids over-depreciating on paper).

When valuing for sale, you might actually set your asking price near the salvage floor if the item is very old. This makes the offering attractive to bargain hunters while ensuring you recover at least scrap value. On the flip side, if you’re buying used equipment, be wary of prices that are at or below typical scrap value – it could indicate the machine is only good for parts.

In summary, always account for the “leftover” value. For insurance, that might not matter (since a total loss is a total loss), but for appraisals and decisions like trading in vs. running to failure, knowing the salvage value helps. For example, if a decanter’s internals are shot, it might still have a salvage value of $5,000 for the stainless steel. That $5k is effectively the bottom-line value no matter what.

Example (Residual Value): You have a 15-year-old tractor that’s been fully depreciated on your books. However, it still runs and could be a backup or sold to a small farm. Checking online, you see similar 80 HP tractors from the mid-2000s selling for around $15,000. That’s the residual market value. Even if you only get $10k due to some issues, that’s far above scrap metal value (maybe a few thousand). Therefore, in your valuation, you wouldn’t list the tractor as $0 – you’d acknowledge, say, a $12k residual value in fair condition. This logic applies to olive equipment too: an old olive washer or oil storage tank might be fully written off in accounts, but it has residual usefulness that someone will pay for.

Each method has its strengths. The table below summarises and compares these approaches:

Each method yields a piece of the puzzle. In practice, when preparing a valuation (for example, for a financial statement or an insurance schedule), you might list multiple figures: “Depreciated value: $X; Likely market value: $Y; Replacement cost: $Z.” This gives a range and context rather than a single uncertain number

Let’s apply the above methods to two concrete scenarios to see how they complement each other:

Scenario 1: Valuing a 10-Year-Old Olive Oil Press

Background: You purchased a medium-sized olive oil press (continuous centrifugal system) 10 years ago for $100,000. It has been used each harvest, processing around 50 tonnes of olives per year. It’s well-maintained, though out of warranty now. You are considering upgrading to a newer model and want to determine a fair sale price or insurance value.

Scenario 2: Valuing a Nearly New Separator (Centrifuge)

Background: You bought a new centrifugal separator (vertical centrifuge for polishing oil) 1 year ago for $20,000. It’s a high-speed clarifier that improves oil quality. Unfortunately, you’re now restructuring your operations and might sell this unit. It’s in “as-new” condition. How to value it?

Valuing farm equipment in Australia comes with some local considerations that can affect prices and depreciation. Here are a few factors particularly relevant to Aussie olive producers:

Depending on your goal – insuring the asset, selling it, or accounting for it – you’ll approach valuation with a slightly different mindset and requirements. Here’s how to handle each:

By implementing the above steps, you not only retain the value of your olive oil machinery but can enhance it relative to similar-aged units on the market. A well-maintained 15-year-old olive press could outperform a neglected 10-year-old press, and its value would reflect that. Many buyers would rather pay more for the former, knowing it was cared for. Good maintenance is like money in the bank for equipment value.

Specialised machinery like over-the-row olive harvesters can hold their value well if maintained, though hours of use and local demand are key factors. For instance, the Colossus harvester pictured (built in Mildura, VIC) had logged about 7,735 hours – yet with components rebuilt and good upkeep, it remains a sought-after asset for large groves. When valuing such equipment, consider service history (e.g. newly rebuilt conveyors or engines), as major refurbishments can extend useful life significantly. Heavy machinery also benefits from many of the tips above: regular cleaning (clearing out olive leaves and dust), timely engine servicing (as per John Deere engine schedules in this case), and storing under cover in off-season all help preserve value. Usage hours are akin to mileage on a car – they directly impact value, but how those hours were accumulated (easy flat terrain vs. rough use) also matters. Keeping detailed records (hours of use per season, any downtime issues resolved) will support a higher valuation when selling to the next operator.

Finally, don’t underestimate the value of operational knowledge and support documents. If you’re handing off a complex piece of gear, providing training to the buyer or passing along your notes (like ideal settings for different olive varieties, or a log of any quirks in the machine and how to manage them) can make your item more attractive, thereby supporting your asking price. It’s not a tangible “value” in dollars, but it eases the sale and might tip a buyer to choose your machine over another.

Valuing olive oil processing machinery and farm equipment requires blending hard numbers with practical insight. By using depreciation formulas, checking market prices, considering the machine’s contribution to your farm, and factoring in replacement costs, you can arrive at a well-supported valuation range. Always adjust for the realities of the Australian market – our distances, climate, and industry size mean context is key. And remember, the way you care for and present your equipment can significantly sway its value.

Whether you’re insuring your olive press, selling a used tractor, or just updating your asset register for the accountant, a thoughtful valuation will pay off. It ensures you neither leave money on the table nor hold unrealistic expectations. Use the following checklist as a guide whenever you undertake a machinery valuation:

Valuation Checklist for Olive Machinery & Farm Equipment:

Valuing farm equipment is part art and part science. The science comes from formulas and data; the art comes from experience and understanding of how your machinery fits into the bigger picture. With the guidelines above, you have tools from both domains at your disposal. Happy valuing – and may your olive machinery serve you efficiently and profitably throughout its life!

Sources